Leading the way in the renewable energy transition.

We're focused on the critical minerals required for energy storage and renewable energy. Our strategy involves acquiring, developing and producing critical mineral deposits essential for a sustainable future.

Find Out More

About us

Critical Minerals Group’s strategy is founded on our outlook for the global energy disruption and transition that is currently underway and the chance to grasp the opportunities arising from the substantial changes in the world around us. The rising standard of living of a growing global population is likely to continue to drive demand for Critical Minerals for years to come. This demand for Critical Minerals will help the world transition through the decarbonisation and electrification phase. The world will need to find a way to meet this growing demand for such minerals, and Critical Minerals Group is well-positioned to meet this new economy mineral demand as the world turns towards a more renewable future.

CMG aims to reduce dilution and drive early-stage revenues through strategic partnerships and corporate transactions to add value to our shareholders while operating to the highest ESG standards.

To support global communities through an energy transition that will deliver a more sustainable and responsible future.

To be a leading high-quality manufacturer of vanadium battery products for the energy storage market and deliver responsible and robust returns.

Aiming to meet the demand for minerals to achieve a carbon neutral future.

Strategy

Our strategy includes acquiring and developing critical mineral deposits to support our manufacturing of high purity battery products essential for a sustainable future.

high quality and reliable products.

adding value with advanced electrolyte facilities, HPA Production, and molybdenum processing.

centring environmental and social responsibility.

setting industry standards through leadership, innovation and strategic partnerships.

Our Critical Minerals

Critical minerals are metals and non-metals considered vital for the economic well-being of the world's major and emerging economies, yet whose supply may be at risk due to geological scarcity, geopolitical issues, trade policy or other factors. Examples of some critical minerals needed for renewable energy include Vanadium and Copper.

Vanadium is a silver-grey ductile and malleable metal that has a natural resistance to corrosion and stability against alkalis, acids and saltwater. This unique mineral is classified by the Australian Government as a ‘Critical Mineral’ and is strongly backed and supported by Federal and Queensland Governments. These vanadium resources will play a vital role in the development of a new energy economy.

Vanadium is one of a small group of elements whose atomic structure allows them to form a range of ions with different charges. This property is unique to transition metals and sets them apart from other elements in the periodic table. Vanadium is more distinctive in that it has four oxidation states (2+, 3+, 4+ and 5+) – this unique combination enables its use as both the anode AND the cathode in the vanadium redox flow battery which is playing an increasingly important role in renewable energy storage.

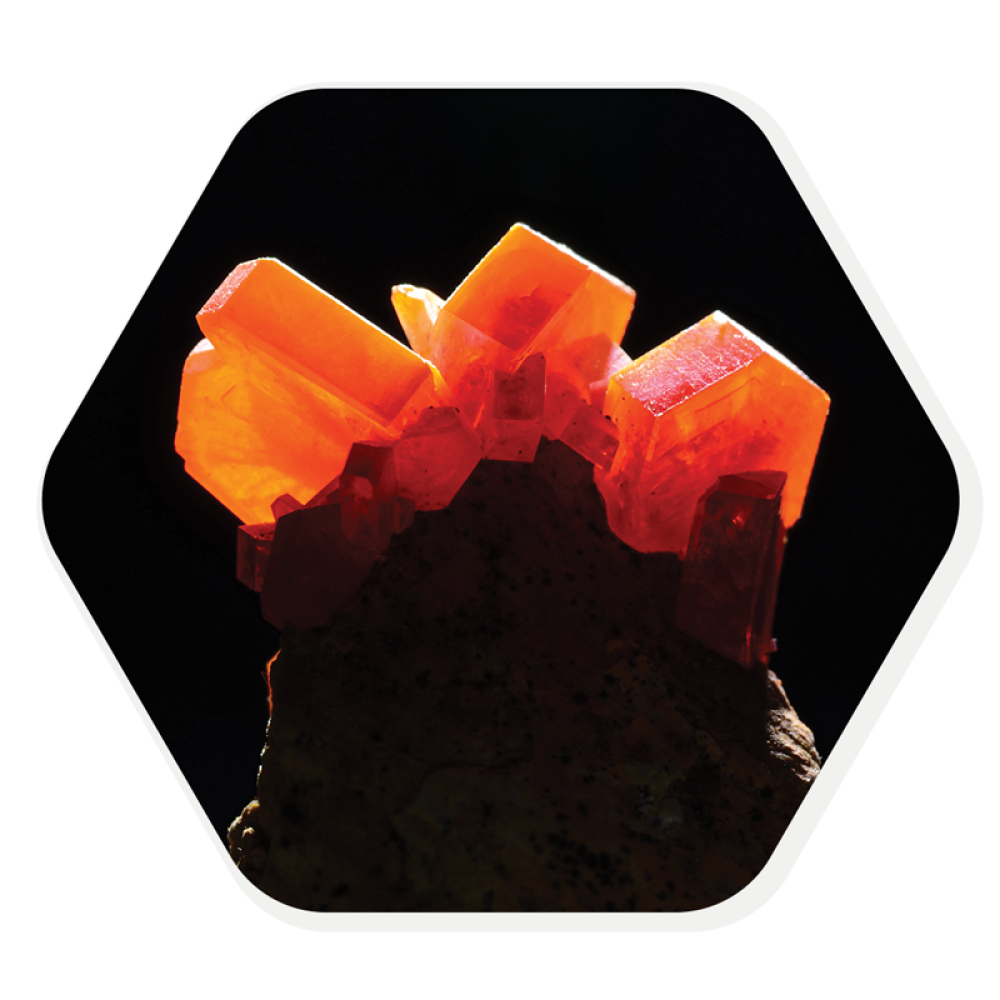

Vanadium for use in the in the battery industry is usually quoted as vanadium pentoxide V205, and is a brown/yellow solid, although when freshly precipitated from an aqueous solution its colour is deep orange.

The most beautiful metal of all…

Vanadium is not found in its metallic form but rather in more than 60 minerals as a trace element in a range of rock types. Vanadium resources may be found in magnetite (iron oxide), aluminium ore, sandstone, coal or oil shale. Once Vanadium is extracted and dissolved in water, it transforms into several bright shades of the rainbow, thus being described as “the most beautiful metal of all."

Demand is growing for renewable energy across the world. As our markets shift towards wind, solar and geothermal production, the need for safe and reliable energy storage is powering significant growth in Australian vanadium mining.

The unique properties of vanadium mean that it will play a critical role in renewable energy storage. This is reflected by strong growth in the market, with vanadium consumption for battery production expanding 42% between 2021 and 2022.

Increases in vanadium consumption are largely due to Vanadium Redox Flow Batteries (VRFB), an energy storage solution that provides a stable, reliable and cost-effective alternative to lithium batteries.

This market expansion is excellent news for the new energy economy. It also presents opportunities in the mining, research and manufacture of vanadium batteries. With vanadium earning a Critical Minerals classification from the Australian Government, the local industry is forecast to become a major player on the global market, and Critical Minerals Group is well-positioned to make the most of the shift.

With no electrolyte degradation and simple mechanical parts, VRFBs can deliver a lifespan of 25 years or more. This far outperforms the 10-year life expectancy of lithium battery technology.

Vanadium redox flow batteries can be easily scaled by increasing the size of the electrolyte tanks or installing additional modules, making them suitable for small and large grid applications.

The vanadium electrolyte that powers VRFB systems does not degrade during charge and discharge cycles. VRFBs have been measured to retain 100% of their capacity over 14,000 cycles.

VRFBS’s are more easily scalable with regards to both energy and power density, allowing them to be configured to deliver the energy to power ratio required by any application

VRFB systems are inherently safer than lithium, with the electrolyte being stored separately from the cell. Electrolytes are not flammable and highly stable, reducing reactivity during idle periods.

The vanadium electrolyte in VRFB systems can easily be recycled and reused. This minimises the environmental impact and reduces the long-term operating cost of replacing vanadium solution.

VRFB's are low cost and continuing to reduce $/kwhr as technology improves and battery production volumes increase.

Liquid electrolyte used in VRFBs can be nearly 100% recovered and, with minimal processing steps and cost, reused in another battery application.

Projected vanadium demand and energy storage by 2030. 141GWh in 2022.

The Vanadium consumption for batteries is forecast to grow at an average of 20.7% a year from 2020 to 2029.

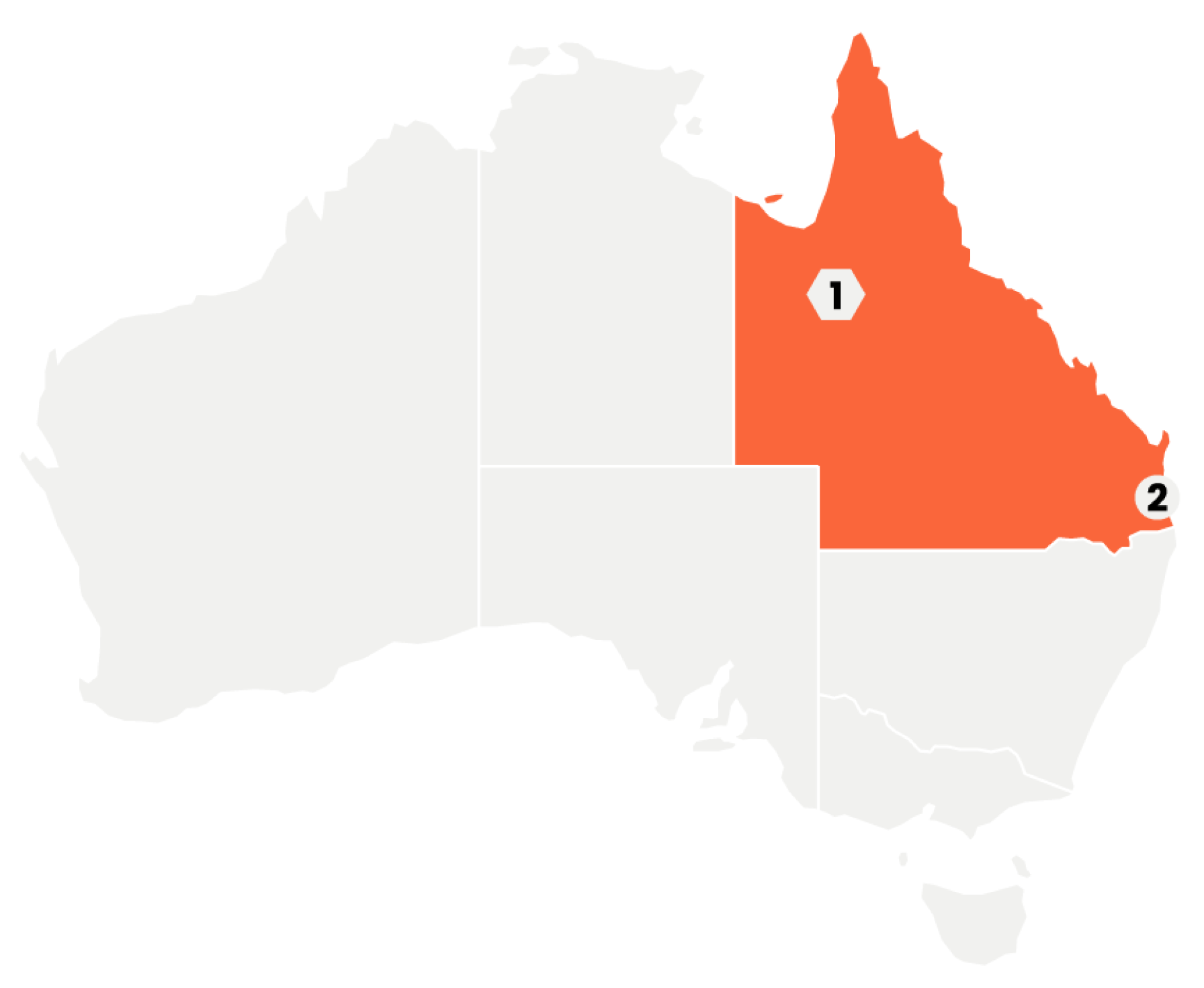

Queensland Resources

of Australia’s known vanadium

deposits are in Queensland

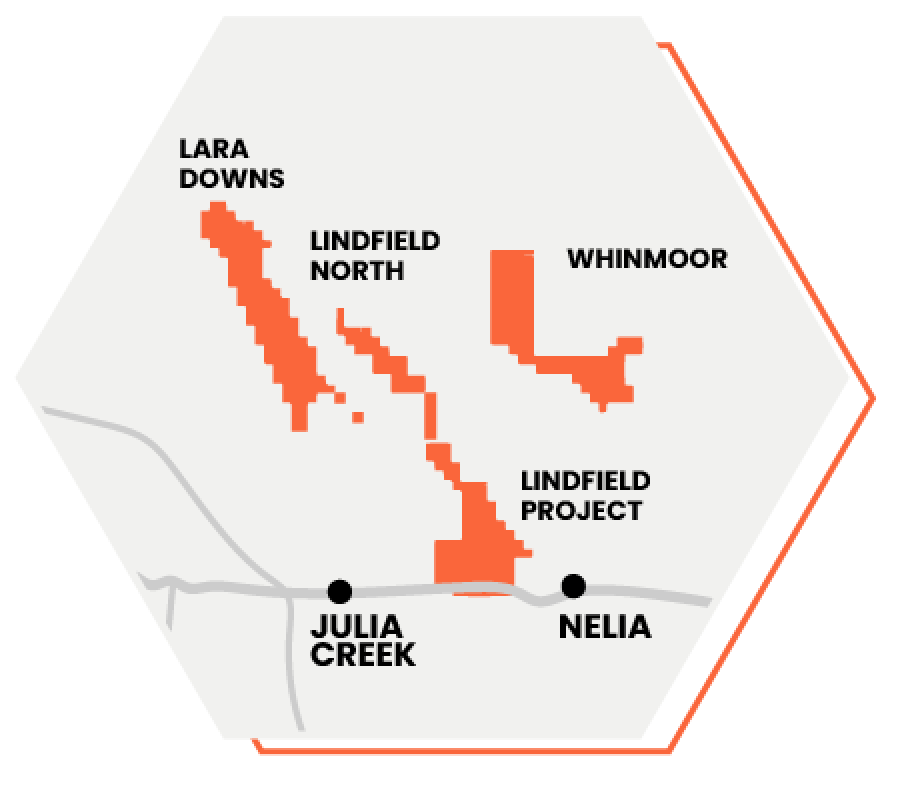

Critical Minerals Group (CMG) is a 100% owner of the Lindfield project, a 295km² tenement in Northwest Queensland located near the town of Julia Creek.

As one of the leading Vanadium prospects in Australia, this project has a JORC 2012 Mineralised Resource Estimate of 713mt at 0.32% V205, 3.4% Al2O3 and 130g/t Mo, with over 68% of this in the Indicated category.

The Vanadium is partially contained within the oxidized zone which has significant benefits.

- V205 grades are typically higher in the oxidized zones than in the deeper fresh zones.

- Other minerals are present, including HPA and Mo, based on surrounding tenement drill results.

- Significantly lower Vanadium mining costs due to a low strip ratio.

With the opportunity to expand LOM with potential upside in Resource subject to further evaluation.

Tonnes

The Project has the practical and financial attributes to potentially develop a successful 4 million tonne per annum ROM vanadium mine.

Mineral resource estimate of 713Mt at 0.32% V205, 3.4% Al2O3 and 130ppm Mo. This includes 491 Mt @ 0.32% V205

72% of the resource is located within 20m from surface.

Feasibility Study underway Pilot Plant about to commence.

Potential after-tax IRR of approximately 17%, from the vanadium pentoxide and molybdenum trioxide products streams.

Low risk jurisdiction with Government support. State and federal governments engaged in Approvals pathways.

NPV

Assuming USD$9.50 / lb 98.5% V205 , USD$57.5 / kg 99% MoO3 , FX of $0.68 and Royalty Rate 2.5%).

Capital Cost

Estimated direct capital costs (excluding indirect costs, EPCM, owners’ costs and contingency).

Located in rich vanadium mineral zone, close to infrastructure, services, and other advanced mines. Located close to Julia Creek, main highway and rail, power and water.

Product

Potential for HPA production as part of the vanadium processing operations. separator, LED’s, Sapphire glass. Molybdenum is also included as a potential by-product.

1 - Refer ASX Release – “Significant Increase to Mineral Resource Estimate” – 10 May 2024. 2 - Refer ASX Release – “Revised Release of Scoping Study Results” - 9 November 2023

CMG has 3 other tenements within a 40km radius of Lindfield which are also prospective for vanadium, alumina and molybdenum. These include Whinmoor (EPM28631). Lindfield North (EPM28635) and Lara Downs (EPM28636).

- Approximately 320 km2 and located approximately 60km northeast of Julia Creek

- Prospective for vanadium, alumina and molybdenum

- Preliminary target areas identified and preliminary drill program define

- Approximately 378 km2 and located approximately 40km north of Julia Creek

- Prospective for vanadium, alumina and molybdenum

- Geology currently under review to further refine preliminary drill progra

- Approximately 115 km2 and located approximately 40km northeast of Julia Creek and directly adjacent to the Lindfield Project

- Preliminary target areas identified and preliminary drill program define

Our copper tenements are currently the subject of a farm-in agreement with True North Copper Limited (ASX announcement 7 December 2023)

- Approximately 70km2 and located approximately 5km south of Cloncurry.

- Prospective for IOCG (iron ore copper gold) mineralisation with several historical samples showing copper and gold anomalies, with additional known magnetic anomalies

- Approximately 51km2, in three discrete parcels, located approximately 15km east of Cloncurry.

- Prospective for IOCG (iron ore copper gold) mineralisation with hole 2 in a previous program showing 13m @0.2% Cu and 0.11g/tAu from 169m

Board & Leadership Team

Mr Broome was appointed as the Non-Executive Chairman of Critical Minerals Group in October 2021.

He is a professional Director and Business advisor with over 40 years experience in the Metals, Mining and Energy Industries. Alan has extensive knowledge of the Mining Industry accumulated through involvement with Mining technology companies, government agencies and major international Mining companies in promoting Australian mining and developing global trade.

Currently the Chairman Emeritus of Austmine and Micromine. He is the Non-Executive Chairman of Strategic Minerals Plc, New Age Exploration Limited (ASX:NAE), and Nuenz Limited. He is also a Non-Executive Director for UON Energy. Mr Broome received the Order of Australia (AM) for services to mining in 2000, and has received multiple awards during his career.

Mr Winter was appointed as the Managing Director and CEO in August 2023.

He is an experienced mining engineer with almost 30 years working across all aspects of mining exploration, development, engineering, financing and operations.

After early years at MIM, BHP and then managing major projects at Thiess, Scott progressed to C-suite roles including CEO and MD of MACH Energy Australia, COO for Mineral Resources Ltd (ASX:MRL), CEO (Surface) at Perenti Group and Interim CEO and Director at Jupiter Mines Ltd (ASX:JMS).

Mr Kovac has over 15 years experience in senior management and executive roles in the mining sector.

He is the CEO of Idemitsu Australia Pty Ltd, and is a Non-Executive Director for Delta Lithium Ltd, Vecco Group Pty Ltd, and Low Emissions Technology Australia Ltd.

Mr Kovac holds a Bachelor of Engineering – Mining (hons) and an MBA. He is a Graduate of the Australian Institute of Company Directors and is a Fellow of the AUSIMM.

Mr McClure is an experienced executive with over 18 years of finance and corporate advisory experience.

Mr McClure holds a Bachelor of Business majoring in finance and has extensive experience as a company director across listed and unlisted entities in the resource, finance, e-commerce and industrial sectors.

Mr Gallagher is an experienced company secretary with a broad corporate skillset, having held the roles of company secretary, CEO and director on a number of ASX-listed companies.

He holds a Graduate Diploma in Applied Corporate Governance and Information Systems, a Master in Commerce and a Bachelor of Economics, and is a Fellow of the Governance Institute of Australia.

Mrs Walsh was appointed as the Chief Financial Officer in March 2025.

Trudy is an experienced Finance Executive and CFO having held a number of senior leadership roles in listed and unlisted companies.

Mrs Walsh brings over 25 years in financial management, and is highly experienced in corporate strategy and the financial and commercial development of companies involved in engineering, manufacturing and the renewables sector.

Mrs Walsh is a CPA who holds an MBA and a graduate diploma in Risk & Corporate Governance.

Mr Kelly was appointed as the Chief Operating Officer in November 2024.

He has over 30 years of experience in senior management roles in the Australian mining and international resource sector.

He is an experienced Mining Engineer, with proficiency in bulk commodities, base metals, and industrial minerals during exploration, development, and operations.

During his career, Pat has undertaken greenfield development and brownfield expansion activities on multiple occasions.

Mr Kelly was previously COO for HSE Mining, and holds an executive MBA, Master’s in Mining Management, and is a Fellow and Chartered Professional of the AusIMM.

Ms Semler is a Metallurgical Engineer with an extensive background in the mining and resources industries, both in Australia and internationally. Her experience encompasses greenfields and brownfields project development, commissioning, operations, cultural transformation, strategic and operational business planning and mine closure.

Ms McCormack is an experienced Communications and Investor Relations professional with experience in the not for profit sector, financial services, distribution, and manufacturing.

Ms McCormack holds a Bachelor of Mass Communication majoring in Public Relations and Media and Communication, and is currently studying a Graduate Certificate in Corporate Governance and Risk Management

Partnerships

CMG is seeking to leverage the significant grants and incentives put in place to develop domestic production of vanadium, particularly for use in Vanadium Batteries as a grid-scale energy solution.

By investing in domestic battery production, Queensland is taking control of its clean energy future and ensuring a reliable, renewable energy supply for generations to come.

Department of Energy and Climate, Queensland Government

Contact Us